How to Choose the Right Auto Insurance Coverage

When selecting auto insurance coverage, it is essential to carefully evaluate your individual needs and circumstances. Consider factors such as your driving habits, the value of your vehicle, and any potential risks you may face on the road. Understanding these aspects will help you determine the level of coverage that is right for you.

Another important factor to consider is your budget and how much you can afford to pay for insurance premiums. It is crucial to strike a balance between adequate coverage and affordability to ensure that you are adequately protected without overspending. Take the time to compare quotes from different insurance providers to find the best policy that fits your needs and budget.

Assess Your Driving Habits and Risk Factors

Understanding your driving habits is crucial when it comes to selecting the right auto insurance coverage. Factors such as how frequently you drive, the distance you cover, and the purpose of your trips can all influence the level of coverage you may need. For instance, if you have a long daily commute or often drive through busy city streets, you might want to consider comprehensive coverage to protect against a wide range of risks.

In addition to your driving habits, it’s important to evaluate your risk factors on the road. This includes considering factors like your age, experience, and driving record. Younger drivers or those with a history of accidents may be considered higher risk by insurance companies, which could result in higher premiums. By realistically assessing your driving habits and risk factors, you can make an informed decision on the type and level of auto insurance coverage that best fits your needs.

Understand the Different Types of Auto Insurance Coverage Available

When it comes to selecting auto insurance coverage, it’s crucial to familiarize yourself with the various types available. Liability coverage is mandatory in most states and covers damage to other people’s property or injuries in an accident where you are at fault. This coverage does not pay for your own car’s repairs or medical expenses.

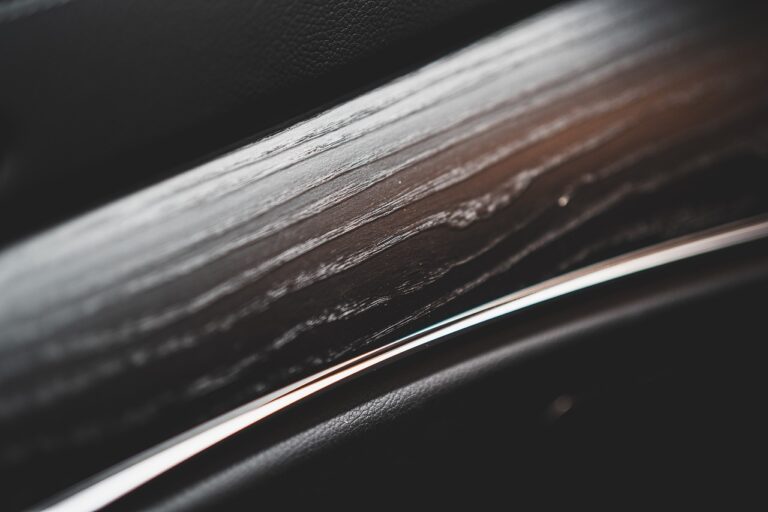

Comprehensive coverage is optional but important for protecting your vehicle from non-collision incidents like theft, vandalism, or natural disasters. Collision coverage, another optional policy, covers damages to your car in the event of a collision with another vehicle or object. Understanding these different types of auto insurance coverage can help you make an informed decision based on your needs and budget.